Before you can renew your business permit, join a government bidding, or apply for a loan, you will need one important document: a tax clearance.

A tax clearance is an official document issued by the Bureau of Internal Revenue (BIR) that confirms an individual or business has no unpaid tax obligations. It serves as proof that all tax returns have been filed correctly and all dues have been settled. This document is necessary for government transactions, business renewals, and financial applications.

This 2026 guide explains everything you need to know about getting a BIR clearance. It includes the latest requirements, a step-by-step process, a sample format, the validity period, and fees to help you complete your application smoothly.

What Is a Tax Clearance?

A tax clearance is an official certification issued by the Bureau of Internal Revenue (BIR) that proves an individual or business has no unpaid taxes, penalties, or outstanding liabilities. It serves as confirmation that all tax obligations have been properly filed, paid, and updated with the BIR. Having a clearance is important because it is one of the main requirements for government bidding, business permit renewal, job applications, and bank transactions. Individuals and companies also use it to show their credibility and compliance with national tax laws.

Tax Clearance and Tax Clearance Certificate Difference

In the Philippines, the terms Tax Clearance and Tax Clearance Certificate are often used interchangeably, but they have slightly different meanings.

A Tax Clearance refers to the process of securing approval from the Bureau of Internal Revenue (BIR) that confirms you have no unpaid taxes or pending obligations. Once this process is completed, the BIR issues the Tax Clearance Certificate, which is the official document or physical proof that your tax record is clear and updated.

You may also hear people or offices refer to it as a BIR Clearance, which is another common term for the same certificate. Whether it is called a Tax Clearance, Tax Clearance Certificate, or BIR Clearance, all refer to the same official confirmation from the BIR that your tax obligations have been fully settled.

Types of Tax Clearance

A TCC may vary depending on who applies for it and how it will be used. The Bureau of Internal Revenue (BIR) issues several kinds of clearances to meet the needs of individuals, professionals, and businesses.

Individual Tax Clearance

This type of clearance is for employees, freelancers, and self-employed professionals. It proves that the person has filed and paid all taxes under their name and has no outstanding obligations with the BIR.

Business Tax Clearance

Required for business registration, renewal, or company compliance, this clearance verifies that a business has fulfilled its tax duties and can legally operate without pending liabilities.

Tax Clearance for Bidding

Government agencies often require this before awarding contracts. It confirms that the bidder has a clean tax record with the BIR clearance.

Tax Compliance Certificate

This is issued to corporations or organizations to verify their compliance with tax regulations. Some companies refer to this as a BIR clearance or tax clearance certificate, as the terms are often used interchangeably in business transactions.

Tax Clearance Requirements 2026

Before applying, prepare all necessary documents to avoid delays. The clearance requirements may vary depending on your application type. Below is the complete list of requirements based on the latest BIR clearance requirements for 2026.

For Individuals

- Valid government-issued ID

- Tax Identification Number (TIN)

- Latest Income Tax Return (ITR) or Certificate of Employment

- Community Tax Certificate (Cedula)

For Businesses

- BIR Certificate of Registration (Form 2303)

- Latest Audited Financial Statement and ITR

- Mayor’s Business Permit or Business Renewal Permit

- Proof of settled tax liabilities (BIR Form 0605)

- Documentary Stamp Tax (if applicable)

For Bidding or Accreditation

- Application letter addressed to the BIR Regional Office

- PhilGEPS Registration Number

- Previous clearance copy (if for renewal)

Tip: Always bring both original documents and photocopies for verification. It is also helpful to organize your papers in clear folders to speed up the review process.

Preparing the correct BIR clearance requirements in advance ensures a smoother application and prevents unnecessary back-and-forth with your assigned Revenue District Office.

How to Get Tax Clearance (Step-by-Step)

Getting your BIR tax clearance is a straightforward process if you know what to prepare and where to go. Below is a complete step-by-step guide.

Step 1: Visit your assigned BIR Revenue District Office (RDO)

Start by going to your registered BIR RDO, where your business or personal TIN is listed. This is where to get tax clearance, since each RDO handles its own applicants.

Step 2: Secure the Application Form

Ask for BIR Form 2136 or the equivalent clearance application form. Some RDOs may provide this online or through email.

Step 3: Fill out and attach all required documents

Provide accurate information and attach all the documents listed in the requirements section. Make sure your TIN, name, and address match your BIR records.

Step 4: Pay any unsettled taxes and get your payment receipt

Before submission, ensure you have settled any unpaid tax dues. Payments can be made through the BIR cashier, accredited banks, or digital payment options like GCash or PayMaya. Keep the payment receipt as proof.

Step 5: Submit your application at the Accounts Receivable Section of your RDO

Submit your complete application folder, including supporting documents and proof of payment. The officer will review your papers before officially receiving them.

Step 6: Wait for verification

The verification process usually takes three to seven working days. The BIR will check if your tax records are clear and if there are no pending liabilities.

Step 7: Claim your Tax Clearance Certificate

Once approved, you can claim your tax clearance certificate personally at your RDO. Some offices also allow you to request a soft copy via email.

Note: Certain RDOs now accept pre-screening and document submission through email or through eBIRForms and eFPS portals. This helps reduce wait times and speeds up the process, especially for business renewals and corporate applicants.

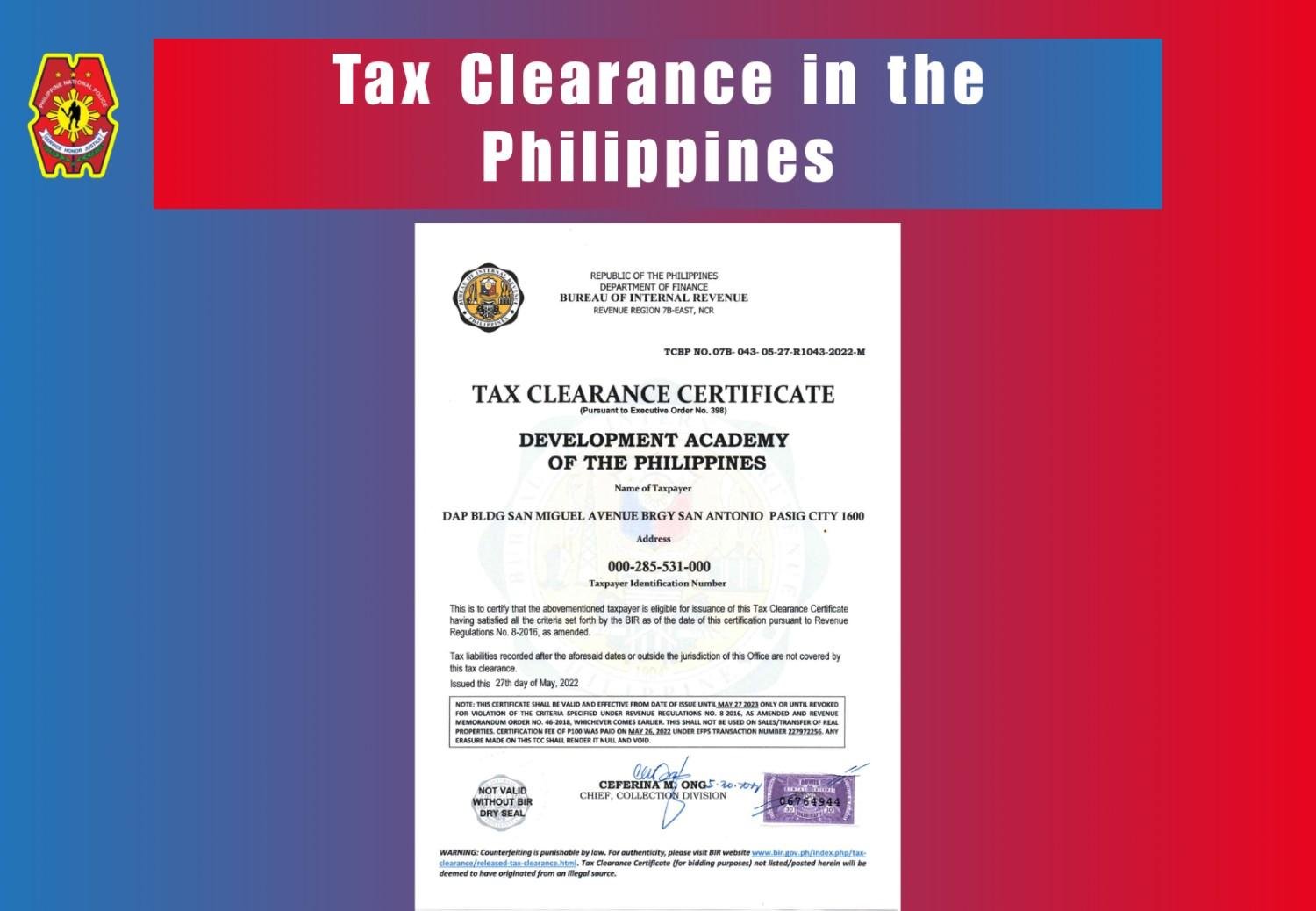

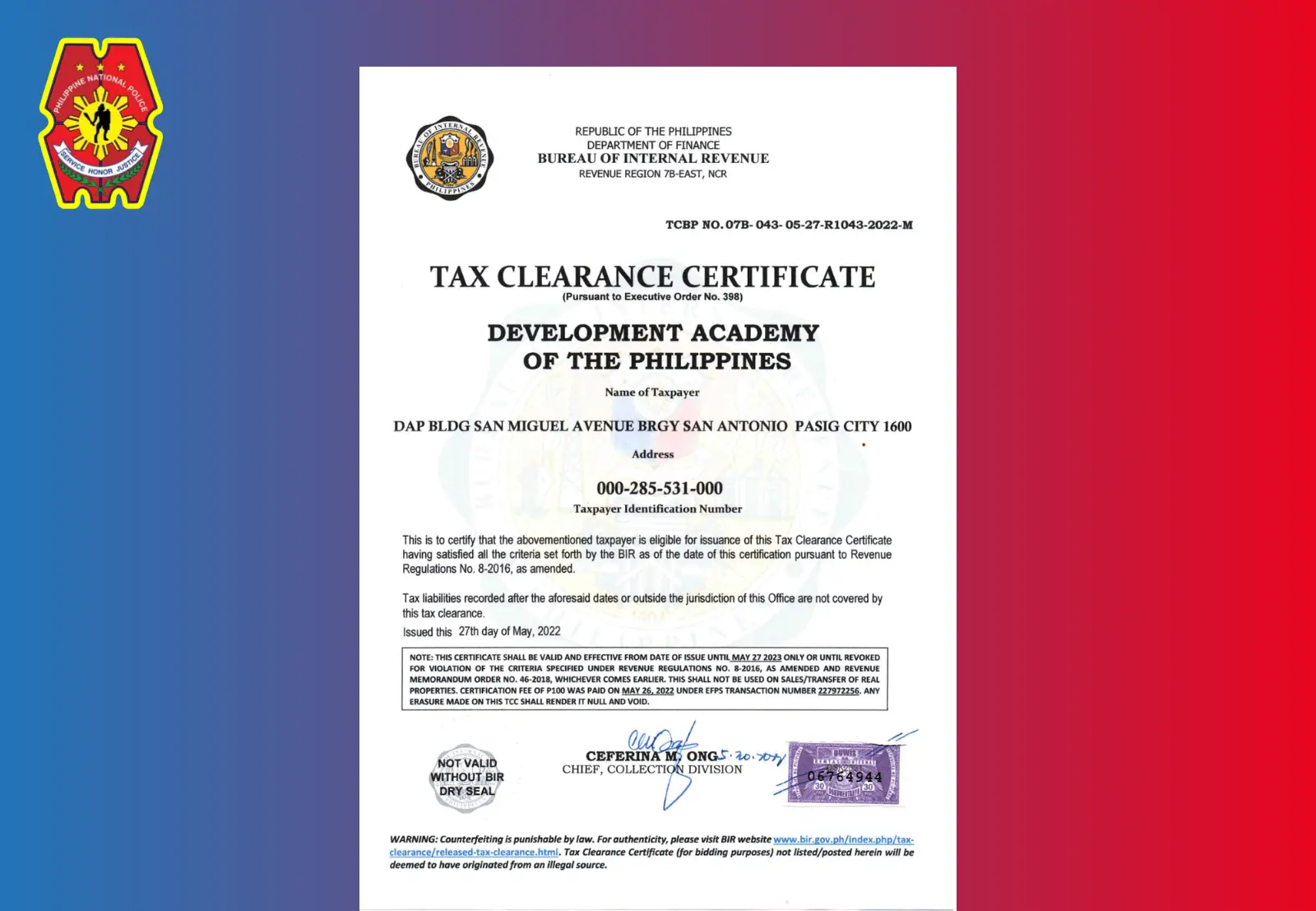

Tax Clearance Certificate Sample and Format

A clearance sample provides a clear idea of what your issued certificate will look like once approved by the Bureau of Internal Revenue (BIR). It usually includes the following details:

- Taxpayer or Business Name

- Tax Identification Number (TIN)

- RDO Code and Address

- Purpose of Clearance (such as employment, bidding, or business renewal)

- Date of Issuance and Validity Period

- Signature of the Authorized BIR Officer

- Official BIR Seal or QR Verification Code

Each issued certificate serves as formal proof that the taxpayer has no unsettled liabilities and is in good standing with the BIR. The layout may vary slightly by regional office, but the essential details remain the same.

Today, both digital and printed copies of the certificate are widely accepted. Most new versions now include a QR code that allows agencies and employers to verify the document’s authenticity online.

Tax Clearance Validity and Processing Time

The BIR tax clearance validity and processing period may vary depending on your assigned Revenue District Office (RDO) and the completeness of your documents.

In most cases, the processing time is 3 to 7 working days. This allows the BIR to verify your tax records, payments, and other compliance details before issuing the certificate.

A BIR tax clearance is usually valid for six months from the date of issuance. Once it expires, you need to reapply or renew it, especially if you use it for business permit renewal or government bidding.

Common Reasons for Delay or Rejection

When applying for a tax clearance, even minor errors or missing details can delay the process or result in rejection. The most common reasons include the following:

- Unsettled tax liabilities: Any unpaid taxes, penalties, or arrears must be settled before applying. The BIR will not release your clearance until all dues are cleared.

- Mismatched TIN or name: Inconsistent records between your application and the BIR database can delay approval. Always verify and correct your information with your assigned RDO.

- Incomplete requirements: Missing documents such as your ITR, business permit, or proof of payment can result in processing delays or disapproval.

- Pending audit: If your account is under audit or investigation, your certificate will not be issued until the findings are resolved.

Being thorough with your documents and verifying all records in advance can save time and prevent reapplication.

Tax Clearance Contact Information

For inquiries or assistance you may contact:

Bureau of Internal Revenue (BIR)

Hotline: (02) 8538-3200

Email: contact_us@bir.gov.ph

Website: www.bir.gov.ph

You may also visit your nearest Revenue District Office (RDO) for local guidance and document submission.

Conclusion

A tax clearance proves your compliance with the Bureau of Internal Revenue, making it an essential document for business operations, employment, and government dealings. It confirms that you or your business have no pending tax obligations and are in good standing with the BIR. To avoid delays or penalties, apply for your clearance early and double-check all your documents before submission.

FAQs

1. What is a tax clearance used for?

A tax clearance is issued to confirm that an individual or business has no outstanding tax obligations. It is often required for business permits, bidding, and employment.

2. How long is a tax clearance valid?

A BIR tax clearance is generally valid for six months from the date of issuance, depending on the purpose and issuing office.

3. Where can I apply for a BIR tax clearance?

You can apply for a BIR clearance at your assigned Revenue District Office (RDO) or through the BIR eFPS/eBIRForms portal if your region supports online filing.

4. What are the requirements for tax clearance?

The requirements for tax clearance include a valid ID, TIN, ITR, business permits, and proof of tax payments. Business applicants may need additional documents.

5. Can I get tax clearance online?

Yes. Some RDOs allow applicants to submit documents and request tax clearance certificates through email or the BIR’s online portals.

6. What is the difference between tax certificate and tax clearance?

A tax certificate only shows tax registration, while a tax clearance confirms that there are no unpaid taxes or pending issues.