If you work, run a business, or deal with certain government transactions in the Philippines, you need a Taxpayer Identification Number (TIN) and a TIN ID. This card is proof of your tax registration and can be used as a valid ID in many transactions.

In this 2026 guide, you’ll find the requirements, step-by-step application for both physical and digital TIN IDs, verification methods, fees, and solutions to common issues.

What is a TIN ID?

A TIN ID is an identification card that shows your Taxpayer Identification Number, a unique nine-digit code given to every taxpayer in the Philippines. It is issued only by the Bureau of Internal Revenue (BIR) and serves as proof that you are registered as a taxpayer.

This is mainly used for tax purposes, but it is also accepted as a valid government ID when opening a bank account, applying for a job, getting a police clearance, or completing other official transactions.

In the Philippines, a TIN ID has nationwide legal validity, meaning it can be used for identification anywhere in the country. Whether in physical or digital format, it is recognized by government agencies, private companies, and financial institutions.

Physical vs Digital TIN ID

Physical TIN ID Card

The Physical TIN ID is the traditional plastic card issued by the BIR. It comes in a horizontal format, showing your name, photo, signature, address, TIN number, and issue date. New versions include a QR code that agencies can scan to confirm the card’s authenticity.

Digital TIN ID Card

The Digital TIN ID is the newer version, officially launched in November 2023 through the ORUS BIR portal. It is in a vertical format and also has a QR code for quick verification. Once approved, you can download it instantly and print a copy if needed. The digital format is especially useful for those who want a faster and paperless process.

Comparison: Physical vs Digital TIN ID

| Feature | Physical TIN ID | Digital TIN ID |

|---|---|---|

| Format | Horizontal plastic card | Vertical printable file from ORUS |

| Where to apply | Assigned BIR RDO | ORUS BIR portal (orus.bir.gov.ph) |

| Processing time | Same day or 1–3 working days | Minutes after approval |

| QR code | Yes on newer cards | Yes |

| Acceptance | Accepted nationwide | Accepted nationwide |

| Delivery method | Pick up at RDO | Download from ORUS and print |

| Best for | In-person transactions that prefer a card | Fast online access and a printable copy |

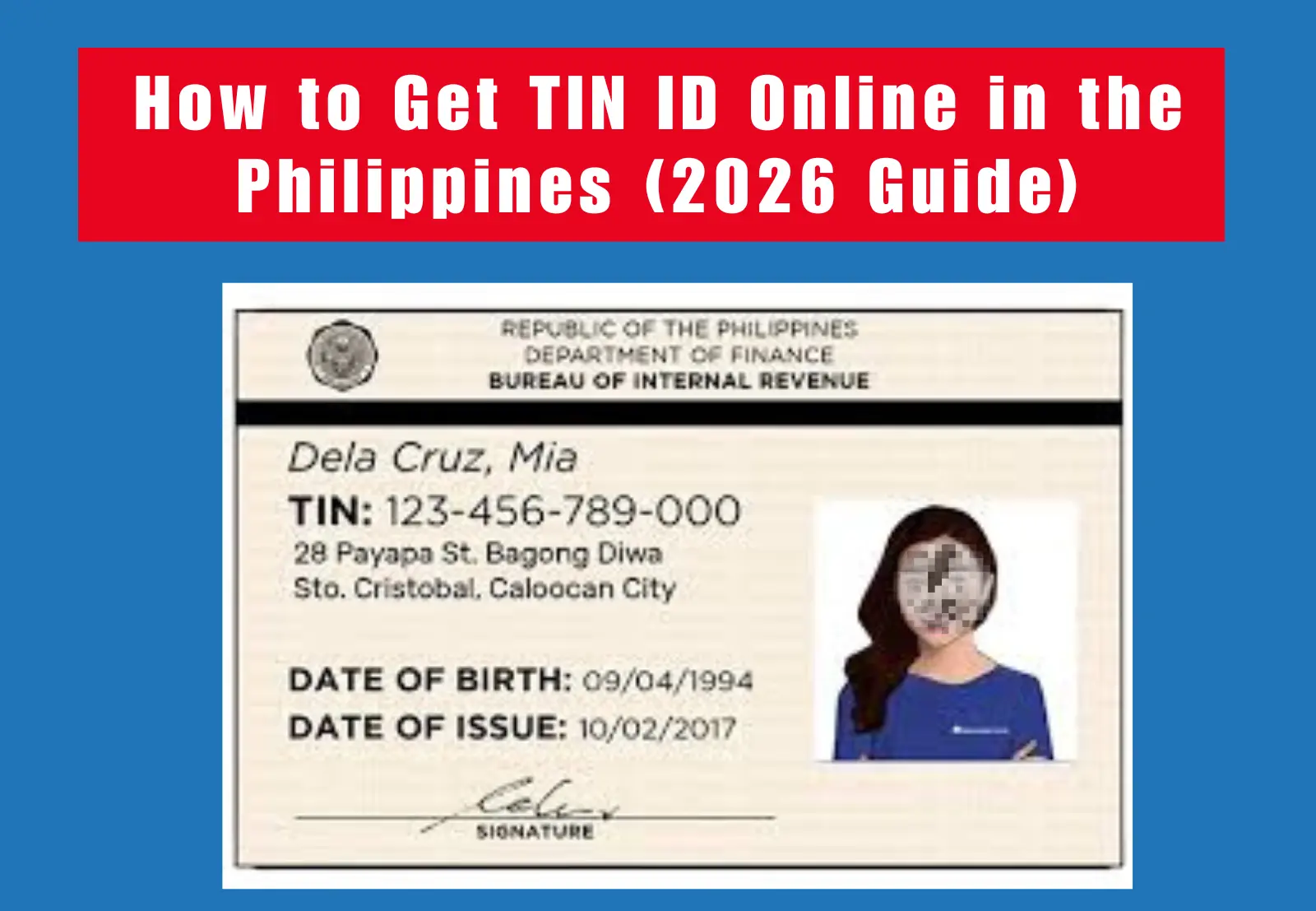

Details on a TIN ID Card

A TIN ID card contains the following information:

- Full name – Confirms the identity of the taxpayer.

- Date of birth – Helps verify personal records.

- Address – Shows place of residence for official correspondence.

- TIN number – The unique nine-digit code assigned by the BIR.

- Issue date – Indicates when the it was released.

- Photo and signature – Adds a personal security layer to prevent misuse.

- QR code – Allows quick scanning by agencies to check authenticity.

These details make the TIN ID a trusted form of identification for both government and private transactions. They also help prevent fraud by ensuring that the card matches the official BIR records.

TIN ID Requirements

The requirements to get TIN ID depend on your employment status or type of taxpayer. The Bureau of Internal Revenue (BIR) may ask for different forms and documents based on your situation.

1. Self-Employed & Mixed Income Individuals

- Completed BIR Form 1901

- Any government-issued ID showing your full name, address, and birth date

- DTI Permit (for sole proprietors) – This proves your business name is registered with the Department of Trade and Industry (how to get DTI permit can be checked on the DTI website or at a local DTI office)

- Proof of business address (e.g., utility bill, lease contract)

- BIR-printed invoices or sample receipts

2. Employees (Local & Foreign)

Local Employees:

- Completed BIR Form 1902

- Any valid government ID (e.g., National ID, Passport, Driver’s License)

- Marriage certificate (if applicable)

Foreign Employees:

- Completed BIR Form 1902

- Passport (bio page, entry visa, and arrival stamp)

- Employment contract

3. Corporations & Partnerships

- Completed BIR Form 1903

- SEC Certificate of Incorporation or CDA Certificate of Registration

- Articles of Incorporation/Partnership

- Proof of business address

- BIR-printed invoices or receipts

4. Students & Unemployed (E.O. 98 Registration)

- Completed BIR Form 1904

- Any valid government-issued ID (if available) or birth certificate from the PSA

- Proof of address

- Marriage certificate (if applicable)

5. Special Cases

- One-Time Taxpayers – Completed BIR Form 1904, valid ID, and documents supporting the transaction

- Estate – Death certificate of the deceased, court documents (if under judicial settlement)

- Trust – Trust agreement and valid IDs of trustee(s)

How to Get TIN ID Online

Applying for a TIN ID online is now easier with the BIR online registration for TIN number through the ORUS BIR (Online Registration and Update System). This service allows first-time applicants to register and get their Digital TIN ID without visiting a Revenue District Office.

Part 1 – Create an ORUS Account (For those without an existing TIN)

- Go to the ORUS BIR website at orus.bir.gov.ph.

- Select New Registration and choose As an Individual.

- Read the requirements and click Create an Account.

- Select Taxpayer and choose Without Existing TIN.

- Confirm the reminder that having more than one TIN is against the law. Click I Agree.

- Under User Type–Transaction, choose Get TIN for Filipino Citizen – E.O. 98 / One Time Taxpayer.

- Fill in your personal details, create a password, and provide a valid email address (this will be your ORUS login).

- Submit the form to complete your orus tin registration.

Part 2 – Apply for Digital TIN ID

- Log in to your ORUS account.

- Select New Registration and choose As an Individual.

- Fill out the online registration form. This has multiple sections, click Continue after each one.

- Upload a clear government-issued ID and a selfie holding the same ID.

- Review all entered details carefully, then click Submit Application.

- Wait for approval from the BIR. Once approved, go to View Your Digital TIN ID in your account.

- Download your TIN ID online copy and save it on your device. You may print it if needed.

How to Apply for a Physical TIN ID (In-person)

If you prefer a physical card, here’s how to get TIN ID at a BIR office.

1. Find your assigned RDO

Contact the BIR hotline or check the BIR website to know where to get TIN ID based on your place of residence or business.

2. Fill out the applicable BIR form

- BIR Form 1901 for self-employed and mixed-income individuals

- BIR Form 1902 for employees

- BIR Form 1904 for students, unemployed, or one-time taxpayers

3. Submit your documents

Include valid IDs, supporting papers, and a 1×1 photo.

4. Processing time

Many RDOs can release the Physical TIN ID on the same day. In some cases, you may need to return in 1–3 working days to collect it.

Once issued, sign your card and keep it in a safe place for future transactions.

How to Apply for a Physical TIN ID (In-person)

If you prefer a physical card, here’s how to get TIN ID at a BIR office.

Once issued, sign your card and keep it in a safe place for future transactions.

1. Personal Details

This section includes your name, rank, badge number, and other identification details.

2. Earnings

Shows your basic salary along with any allowances like rice or clothing allowance, and bonuses you received for that pay period.

3. Deductions

Lists all the amounts taken from your salary, such as GSIS premiums, Pag-IBIG contributions, PhilHealth contributions, and taxes. It may also include other authorized deductions.

4. Net Salary

The final amount you will receive in your account after all deductions are subtracted from your total earnings.

5. Remarks

Any adjustments or special notes related to your pay are shown here, such as corrections or one-time payments.

How to Get TIN Number Online

For first-time applicants, getting TIN number online is simple using the ORUS BIR portal.

First-time registration

Go to orus.bir.gov.ph, create an account, and follow the E.O. 98 or One Time Taxpayer registration process to get your TIN number.

Without a TIN

Select Without Existing TIN during registration. You will be asked to provide personal details, upload a valid ID, and complete the online form.

Important reminder : The BIR issues only one TIN per person. Having more than one TIN is illegal and can result in penalties.

TIN ID Verification & TIN Number Verification

If you need to confirm your details, the BIR offers several ways to do TIN ID verification and TIN number verification.

1. Using the ORUS “TIN Inquiry” Tool

- Log in to your ORUS account at orus.bir.gov.ph.

- Select TIN Inquiry from the menu.

- Enter your TIN number and personal details, then submit.

- The system will show if your records match the BIR database.

2. Using BIR’s Chatbot Revie

- Go to the BIR website at bir.gov.ph.

- Click the Revie chatbot icon at the bottom right.

- Select TIN Validation from the menu.

- Follow the prompts to check your records.

Why Verification Matters

Knowing how to check a TIN number online ensures that your TIN and personal information are correct before using them for official transactions like banking, business permits, and police clearance. This helps avoid delays or rejections caused by incorrect data.

TIN Number Sample

A TIN number sample follows this format: 123-456-789. The Bureau of Internal Revenue assigns this nine-digit code, which is unique to every taxpayer in the Philippines.

No two individuals or businesses will have the same TIN number. It should be kept private and shared only when required for official purposes, such as tax filing, bank transactions, or government applications.

How Much is TIN ID?

If you’re wondering how much is TIN ID, the answer depends on your situation:

- First-time applicants – Free of charge.

- Replacement for lost or damaged card – ₱100 replacement fee.

- Annual registration fee – No longer required since January 2024, as per the BIR’s updated policy.

TIN ID Validity

A TIN ID has lifetime validity and does not require renewal. Once issued by the BIR, it remains valid for as long as your Taxpayer Identification Number is active. This applies to both the physical and digital formats.

How to Replace a Lost or Damaged TIN ID

If your TIN ID is lost or damaged, you can request a replacement from the BIR.

Lost TIN ID

- Prepare an affidavit of loss stating the circumstances of the loss.

- Fill out BIR Form 1905 (Registration Information Update Form).

- Bring a valid government-issued ID.

- Pay the ₱100 replacement fee at the RDO or an authorized payment center.

Damaged TIN ID

- Surrender your damaged TIN ID to the RDO.

- Provide a recent 1×1 photo.

- Fill out BIR Form 1905.

- Pay the ₱100 replacement fee.

Processing Time

Some RDOs release the replacement TIN ID on the same day, while others may ask you to return after 1–3 working days. Always confirm the processing time with your assigned RDO.

Common Issues and Troubleshooting

- ORUS website not loading – Try using a different browser or access the site during off-peak hours when traffic is lower.

- Email not received – Check your spam or junk folder. If still missing, request a resend from the ORUS portal.

- QR code not scanning – Re-download your digital TIN ID to ensure the code is clear and not distorted.

- Incorrect details – File an update request at your assigned RDO using BIR Form 1905 and provide supporting documents.

Conclusion

The TIN ID is an essential identification card issued by the BIR, used for tax purposes and accepted in many official transactions. You can get it either as a physical card from your assigned RDO or as a digital version through the ORUS portal.

It is free for first-time applicants, carries lifetime validity, and is easy to replace if lost or damaged. Applying early ensures you have it ready for banking, employment, or government requirements without delays.

FAQs

1. How can I get a TIN ID for the first time?

You can apply at your assigned BIR Revenue District Office (RDO) for a physical card or use the ORUS BIR portal for a digital TIN ID. Bring the required form and documents based on your taxpayer type.

2. Is Digital TIN ID valid for all transactions?

Yes. The Digital TIN ID is accepted nationwide for both government and private transactions, just like the physical card.

3. Where to get TIN ID in the Philippines?

You can get it from your assigned RDO or download it from the ORUS BIR portal if you choose the digital option.

4. How to check TIN number online?

Log in to the ORUS portal and use the TIN Inquiry feature or use the Revie chatbot on the BIR website to verify your records.